The list of technologies that organizations have at their disposal is never ending, ranging from cutting-edge cloud solutions to sophisticated data and analytics tools. It’s evident that technology plays an extremely important role in today’s businesses as the current economic state has put a strain on how organizations, small and large, operate. To stay afloat or grow, organizations are having to adopt new technologies or upgrade their existing solutions.

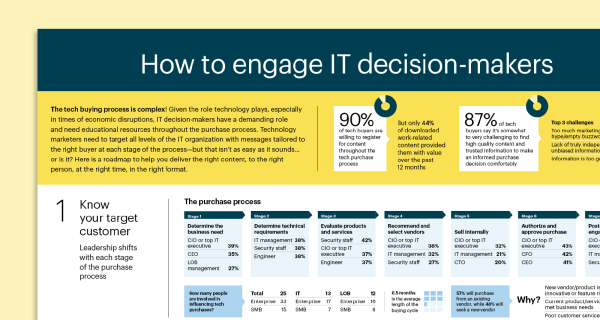

To better understand how IT decision-makers (ITDMs) are reacting to the changing socio-economic climate, Foundry’s 2023 Role & Influence of the Technology Decision-Maker research provides insight into how the technology purchase process differs depending on which technology is being purchased. Compiling data from this study, as well as Foundry’s Customer Engagement research, we’ve outlined some key takeaways for each technology purchase process. You’ll find data on who’s involved in the decision-making process, the content types and information sources relied upon, as well as tech buyers’ openness to new vendors. Explore the findings below to better understand how to shape your marketing strategies.

Cloud computing

- The complexity of the purchase process is increasing as the average number of influencers involved in the cloud computing purchase process is 28.

- The majority of cloud computing focused IT decision-makers say it is challenging to find high-quality content. They seek tailored content based on their industry and technology installed at their organization.

- Tech content sites, white papers and webcasts/webinars are the top sources of information relied upon for cloud computing purchases.

Data and analytics

- More than one-third (38%) of ITDMs say they will increase their spending on data & analytics to become a digital business.

- 97% of data and analytics focused ITDMs have responded to outreach from a potential vendor.

- The purchase process for data and analytics applications is becoming increasingly complex as the number of influencers involved in purchases is up to 27.

Desktops and laptops

- 62% of desktop and laptop-focused decision-makers say that the best way a vendor can introduce a new technology product or service is to provide case studies/proof of concept.

- The number one reason for seeking a new vendor for a desktop or laptop purchase is because the new vendor/product is more innovative or feature reach.

- 63% agree that given the ease of attending, virtual events will continue to be an important source of information for them.

Enterprise software (non-SaaS)

- The enterprise software (non-SaaS) buying committee consists of 26 individuals – 14 IT and 12 LOB.

- Top relied upon information sources for enterprise software (non-SaaS) purchases include technology content sites, analyst firms, peers outside the ITDM’s company, and white papers.

- 68% of enterprise software (non-SaaS) focused decision-makers say they typically spend more time consuming content from known and trusted brands because they’re more confident their time will be well spent.

Enterprise software (SaaS)

- Most enterprise software SaaS applications such as CRM, ERP and business process management tools, are all expected to see either steady or increased budgets over the next 12 months.

- The purchase process for enterprise software SaaS applications is becoming increasingly complex as the number of influencers involved in purchases is up to 24.

- Tech content sites, tech vendors (phone, email) and white papers are the top relied upon information sources for SaaS-focused ITDMs.

IoT devices

- 90% of IoT-focused decision-makers listen to business-related podcasts – their top reasons are to find out about new technology as well as business trends.

- Reasons to seek a new IoT vendor include new vendor/product is more innovative or feature rich, new initiative or request from LOB executives, and current product/service no longer meets business needs.

- 88% say that they are more likely to consider an IT vendor who educates them through each stage of the decision process.

IT services

- Half of IT services-focused decision-makers will seek a new vendor is the new vendor/product is more innovative or feature rich.

- 77% of IT services decision-makers are more likely to respond to outreach from a tech vendor if they know the technology is already being used by a colleague or peer.

- Top relied upon content types include product demos/literature, product testing/reviews/opinions, and technology news.

Mobility

- The mobile tech buying committee consists of 24 individuals – 11 IT and 13 LOB.

- Top relied upon information sources for mobility purchases are peers inside the ITDM’s company, tech content sites, and newsletters.

- 60% of mobile buyers agree that given the ease of attending, virtual events will continue to be an important source of information for them.

Networking

- 87% of networking ITDMs are more likely to respond to outreach from a tech vendor if they know their technology is already being used by a colleague or peer.

- 65% of networking ITDMs agree that given the ease of attending, virtual events will continue to be an important source of information for them.

- White papers, tech vendors, and tech content sites are the top sources of information relied upon for networking ITDMs.

Security

- Slightly more than half of security-focused decision-makers are likely to consider a new vendor over the incumbent(s) when making a quick purchase decision.

- 78% of security-focused decision-makers report that they spend more time reading content from known and trusted brands because they’re confident their time will be well spent.

- $65M is the average annual security budget this year – and 52% of ITDMs expect it to increase in the next 12 months.

Servers and storage

- 75% of server and storage buyers agree that when a technology brand is known and trusted it increases the likelihood that they will be added to the short list.

- 91% find it very challenging to locate enough high-quality, trusted information on major enterprise IT products and services to make an informed purchase decision.

- Tech content sites, white papers and webcasts/webinars are the top sources of information relied upon for server and storage purchases.

Telecommunications

- 6.3 months is the average length of the buying cycle for those purchasing telecom products or services.

- The top reason for why telecom buyers seek out new vendors is because the vendor/product is more innovative or feature rich.

- Video content is a strong way to reach telecom focused ITDMs as 94% say they watch webcasts for business related purposes.

There is much more data to uncover on the purchase process for each technology. Contact us to learn more about the technology that is of most interest to you and explore who is involved in the purchase process, what their major challenges are, where they seek out information and what content types they rely on – all information geared to helping you map out your strategic approach to marketing your products and services to the right buyers.