Latest IDG research reveals who’s involved in each stage of the IT purchase process, key tech purchases being made, and top information sources relied upon by tech leaders

Boston, Mass. – October 19, 2020 – IDG Communications, Inc. – the world’s leading tech media, data, and marketing services company – releases the 2020 Role & Influence of the Technology Decision-Maker study which provides insight into technology’s role in the business and the always evolving tech purchase process. Aside from the status quo factors that result in buying cycle shifts, 2020 brought new challenges as well as opportunities for IT decision-makers (ITDMs). This year’s research found that IT purchase decisions will be controlled more centrally within the IT organization (50%) and that many organizations will see the decision-making process extended, or lengthened (49%). Despite previous uncertainty around technology budgets, we see some promising outlook as 76% of ITDMs say that their tech budgets will either increase or remain the same over the next 12 months. (Click to Tweet)

Necessity of New Tech Purchases

According to CIO’s 2020 Pandemic Business Impact survey released in August, 59% of ITDMs agree that the effects of the pandemic are accelerating their digital transformation efforts. As organizations reevaluate their yearly goals and plans, it’s clear that additional technology is needed to move businesses forward – whether that be to improve work from home effectiveness, expand product portfolios, or establish a return to office plan. Looking at what is driving IT strategy, 32% say responding to internal events (i.e. process changes), 29% say responding to external events (i.e. market changes), and 35% say status quo tasks/keeping the lights on. When asked to think about their likely purchases over the next 6-12 months, the majority of tech leaders expect them to be additions/brand new tech solutions (52%). Out of these additions, 34% are being planned for regardless of recent events and 18% are being made specifically due to recent events (i.e. pandemic). Following additions, 27% say their purchases will be made as upgrades, and 21% as replacements of existing technology.

While new tech purchases have been deemed essential, ITDMs are not just going back to existing partners and are considering new vendors. Asked specifically about quick purchase decisions that have resulted due to the pandemic, 42% say they are extremely/very likely to consider a new vendor. There are a few differences here depending on the technology being purchased – only 26% of those purchasing desktops/laptops are likely to seek a new vendor, compared to 51% for security purchases. Reasons for seeking a new vendor include the current product/service no longer meets their business need (44%), poor customer service (42%), and increased cost/level of investment require by current vendor (41%).

“There’s no question that technology innovation and adoption has always been imperative to the growth of businesses and society overall, however the events of 2020 has created an even stronger need,” said Sue Yanovitch, VP of Marketing, IDG Communications, Inc. “IT leaders are tasked with keeping the lights on during these tumultuous times, while at the same time innovating and increasing operational efficiency. It’s important that IT vendors understand the business needs of tech buyers and provide excellent customer experience and support during these trying times.”

Understanding the Influencers

From the 2019 Role & Influence study, we know that the average buying committee includes 21 people – 11 IT influencers and 10 LOB influencers. Rather than have respondents provide a new number this year, the study asked about how the average number of influencers was expected to shift. From an IT perspective, 30% expect the average number of IT people involved to increase, 59% expect it to remain the same, and only 11% expect a decrease. Looking at LOB individuals involved, 26% expect the number to increase, 57% expect it to remain the same, and 17% think the number will decrease. Despite a fairly balanced buying committee, the study shows that IT is the primary budget holder for 70% of tech purchases. There is some variance by technology being purchased – for example IT is the budget holder for 82% of networking and security purchases but only 53% for web applications.

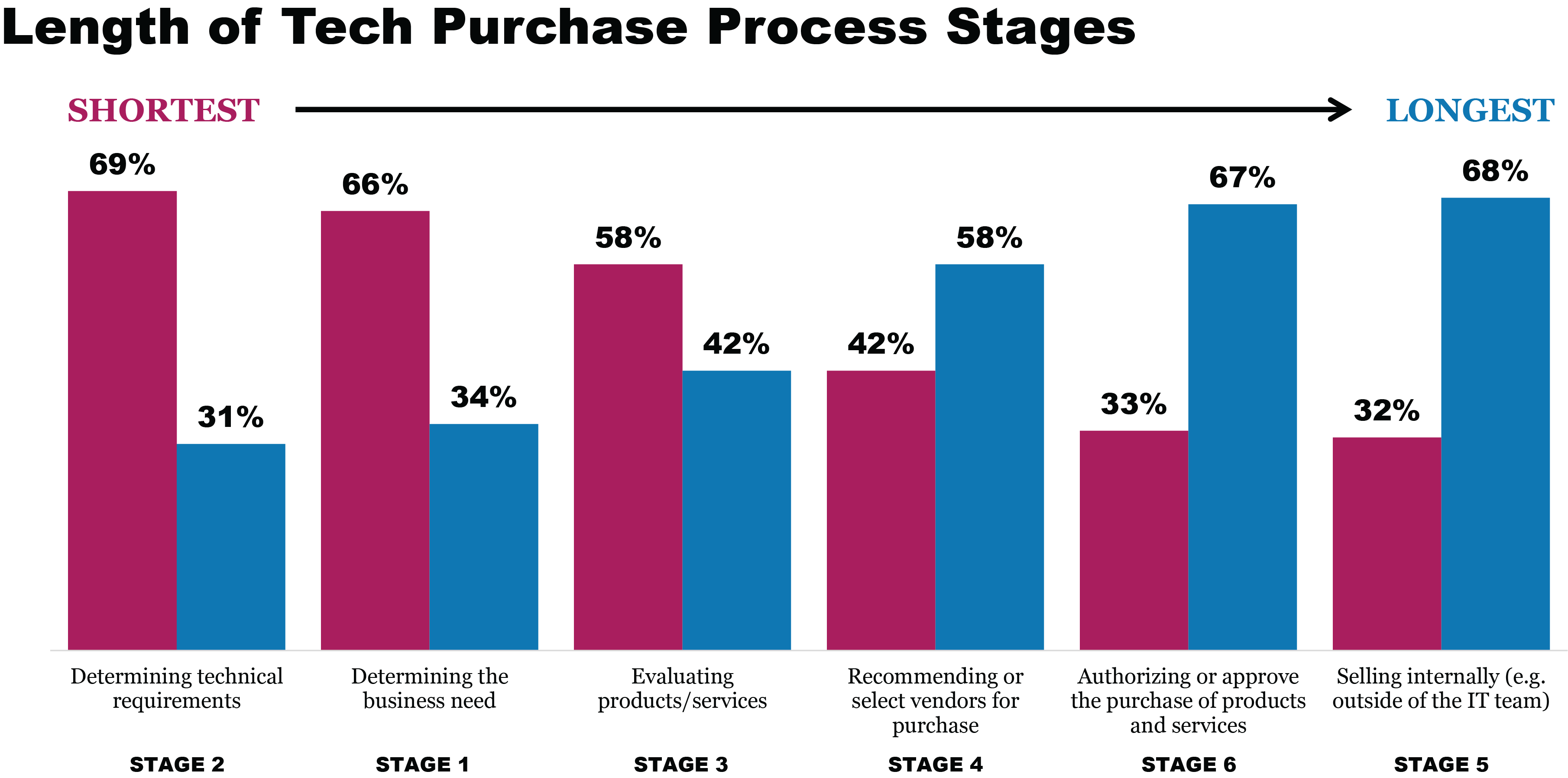

Continuing to prove IT’s strong presence in the purchase process, the 2020 Role & Influence study reveals that IT owns either the first or second leadership position in each stage of the process. Areas where we see business leadership pop-up include determining the business need and approving/authorizing purchases. This year the research also looked at the length of each purchase stage which is essential to better understand the window of opportunity to connect with these IT buyers. Currently, the shortest stages are determining technical requirements and determining the business need. However, over the next 6-12 months, ITDMs anticipate the amount of time needed to determine the business need and authorize/approve purchases to increase.

Sources Powering Education

In 2019, the average number of assets downloaded during the purchase process by tech leaders was five. Asked how they expect this amount to change in the next 6-12 months, 41% of ITDMs think their consumption will increase, 51% anticipate it will remain the same, and only 8% expect a decrease. Again, there are some interesting differences here by technology. Those purchasing IoT devices are more likely to expect an increase (50%), followed by cloud products/services (48%), and IT services (48%).

Leading the way this year in information sources relied upon to stay up-to-date on new technologies are tech content sites (54%), white papers (47%), and webcasts/webinars (45%). Due to remote work and the lack of in-person meetings/events, it is no surprise that webcasts/webinars are heavily sought after, but it is important to show the shift from 2019. Last year, 38% of ITDMs relied upon these virtual sources for information making it the 7th most relied upon source, while this year we see it jump to the third. IT leaders are realizing the value of these virtual platforms as they provide them with the opportunity to engage, learn and bring new solutions and practices back to their organizations.

About the 2020 IDG Role & Influence of the Technology Decision-Maker Research

IDG’s 2020 Role & Influence of the Technology Decision-Maker Research was conducted among the audiences of IDG’s B2B brands (CIO, Computerworld, CSO, InfoWorld, and Network World) representing IT and security decision-makers involved in the IT purchase process for their organization. The survey was fielded online with the objective of understanding the technology decision-makers’ role, how the purchase process is evolving, and the information sources IT leaders use to stay up to date on new technologies. Results in this release are based on 671 respondents across multiple industries and countries.

About IDG Communications, Inc.

IDG Communications’ vision is to make the world a better place by enabling the right use of technology, because we believe that the right use of technology can be a powerful force for good.

IDG is a trusted and dependable editorial voice, creating quality content to generate knowledge, engagement and deep relationships with our community of the most influential technology and security decision-makers. Our premium media brands including CIO®, Computerworld®, CSO®, InfoWorld®, Macworld®, Network World®, PCWorld® and Tech Hive® engage a quality audience with essential guidance on the evolving technology landscape.

Our trusted brands, global 1st party data intelligence and Triblio platform identify and activate purchasing intent, powering our clients’ success. We simplify complex campaigns that fulfill marketers’ global ambitions seamlessly with consistency that delivers quality results.

# # #

Stacey Raap

Senior Marketing & Research Specialist

IDG Communications, Inc.

stacey_raap@idg.com

508-935-4008